- Industry insights

- People in tech

- Product development

- Tech trends at BEECODED

- 9 Jul 2025

How to Reduce Financial Close Time by 3 Days with ERP Workflow Automation

It’s important to have a solid data validation and cleansing step before implementing any automation.

Table of contents

- What is Financial Automation?

- Common Challenges in Financial Close Process

- The #1 Roadblock: Legacy ERP Data Quality

- Compliance and Regulatory Challenges

- Benefits of Automating the Month-End Close

- Integration Strategy: Middleware Over Direct Links

- BEE CODED - Case Study: Procurement Process Transformation

Contributors

Every finance team’s worst nightmare: month-end close with no ERP workflow automation. Every month, accountants find themselves in the middle of chaos: invoices, accounting journals, manual reconciliations and impossible deadlines. They work hours entering data, only to waste some other hours double-checking everything. That leads to tiredness, frustration, and… yes, even more errors.

According to blog.aico.ai, finance teams spend up to 125 full workdays annually posting as many as 30,000 journal entries manually—a stat that already speaks volumes.

But there are smarter ways to handle this. You can reduce financial close time by 3 days with ERP workflow automation. Read on and see how your team can work smarter, not harder.

What is Financial Automation?

In short, financial automation is the use of technology (e.g., AI and machine learning) to automate repetitive financial processes. The objective? Less manual work and fewer errors. For example, accounts payable automation can automatically process invoices, validate VAT codes, check for duplicates, and even approve simple payments.

Of course, in theory, you save time—but in practice, things can be different if the automation isn’t set up properly. For example, an AP invoice automation process can get stuck when an invoice doesn’t have a valid VAT ID. That’s why it’s important to have a solid data validation and cleansing step before implementing any automation.

Common Challenges in Financial Close Process

Manual errors

According to Solvexia.com, almost 90% of financial close errors go undetected until after the close is complete. That means subsequent adjustments and redoing reports—a huge waste of time.

The cause? Repetitive, tedious tasks lead to lack of attention—and when the team is small and time is short, these mistakes accumulate quickly, especially during peak periods.

Difficulty meeting deadlines

Without financial close automation, the monthly close takes 6-7 days or longer, depending on business complexity. With ERP financial automation, the same process can be shortened by up to 3 days, cutting close time by 50-60%.

Two other major challenges

Beyond errors and delays, two critical obstacles stand in the way of effective financial workflow automation:

- Legacy ERP data quality

- Regulatory compliance in automated processes

We’ll explore these in detail in the following sections.

The #1 Roadblock: Legacy ERP Data Quality

Is your ERP old? Do you have incomplete data or five different vendor codes for the same partner? Welcome to the reality many companies face.

Problem: Financial close automation fails with poor quality data. Automations can crash in situations like

- Missing VAT codes,

- Invoices with blank fields,

- Duplicate documents floating in the system etc.

Example: An invoice gets stuck because Supplier A is coded as “Vendor_123” in one system and “SupplierA_GlobCorp” in another.

Solution: Clean your data first. Enforce strict validation rules before automation, because no ERP automation can fix garbage-in-garbage-out.

Compliance and Regulatory Challenges

Constant changes in legislation and compliance requirements put pressure on finance departments. Any reporting errors can lead to fines or reputational damage.

Risk: Automation without strict controls can produce systematic errors. For example:

- Incorrect VAT invoices

- Unprotected personal data (GDPR violations)

Solution: Financial workflow automation must have built-in checks, like automatic VAT validation and audit trails for approvals. This ensures compliance while reducing risks. A robust regulatory framework for automated processes becomes a major advantage.

Benefits of Automating the Month-End Close

- Increased efficiency—You reduce time spent on repetitive tasks (e.g. journal entries).

- Increased accuracy—You eliminate human errors and get accurate reports right the first time.

- Employee satisfaction—By removing repetitive tasks, your team gains time for high-value work. Less frustration means higher engagement and lower turnover.

- Better business decisions—A well-implemented ERP financial automation delivers timely, accurate data, so decision-makers can act fast and with confidence.

Integration Strategy: Middleware Over Direct Links

The integration strategy makes a great difference. Today, we’ll compare two major methods: Direct Integration vs. Middleware.

Direct Integration vs. Middleware: What’s the Difference?

Point-to-Point (Direct):

- Connects applications directly to each other

- Works if you have 2-3 simple systems

- Becomes unmanageable with more systems (spaghetti connections)

Middleware:

- Uses an intermediate “translation” layer between systems

- Perfect for complex mixes:

✓ Legacy ERP systems

✓ Modern CRMs

✓ External payment processors - Key advantage: Swap systems without breaking everything

Why Middleware Wins for Automation

✔ Scalability—Add/change apps without system-wide disruptions.

✔ Standardization—All systems speak one common language.

✔ Legacy-friendly—Ideal for financial automation in established companies.

| Aspect | Direct Integration | Middleware Integration |

| Definition | Each system is directly connected to another system. | A central platform acts as a translator between all systems. |

| Complexity | Simple for 2-3 systems; becomes complex with many. | Manages multiple systems easily, even as the ecosystem grows. |

| Flexibility | Low: Changing one system may break connections. | High: Systems can be added or replaced without breaking others. |

| Scalability | Poor: Connections increase exponentially. | Excellent: One-to-many structure reduces integration overhead. |

| Maintenance | Difficult: More connections mean more maintenance. | Easier: Centralized updates and monitoring. |

| Cost (long term) | Higher as the system grows. | More cost-effective for complex architectures. |

BEE CODED – Case Study: Procurement Process Transformation

Hi, we are BEE CODED. Here is what our customers typically experience:

How we work with you:

- We understand you: you share your current workflow challenges in a quick discovery session.

- We set it up fast: your new automated workflow is quickly implemented and seamlessly integrated into your current systems.

- We stay by your side: we provide dedicated support from start to finish and continually fine-tune your system.

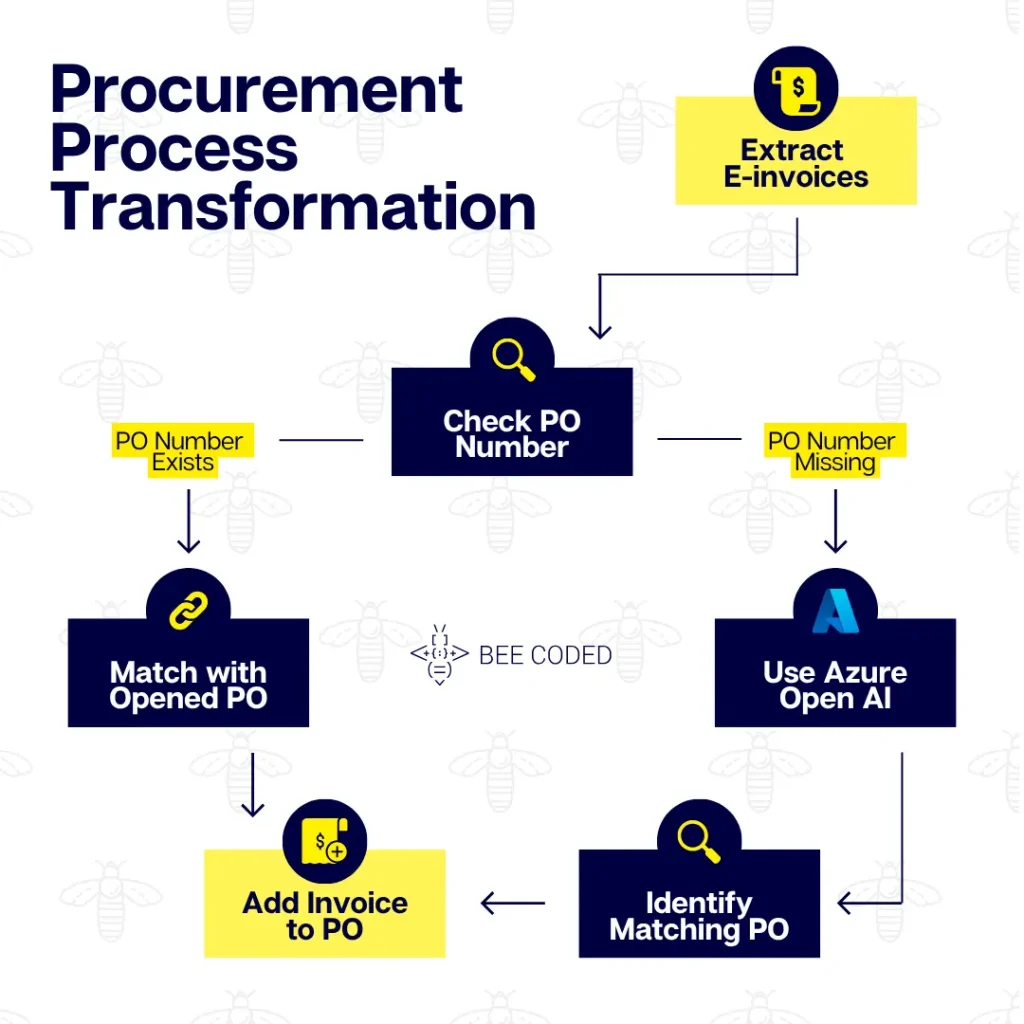

Case Study—Procurement Process Transformation

- Challenge: The procurement process required intensive manual processing of orders and invoices, taking up significant staff time.

- Solution: End-to-end automation for invoice handling, processing, and reconciliation.

- Results:

- Annual savings of more than $200,000 in personnel costs

- Eliminated 2,000 hours of manual labor

- Fully functional implementation in just 2 weeks

Want to reduce financial closing time by 3 days and increase efficiency by 60%? Let’s discuss how we can automate your company’s financial processes, with ERP workflow automation!

Contact us today and take the first step towards a smarter, faster and more future-proof finance department.

Outsourcing vs. In-house Development: Why Romania is the Best Middle Ground

The Talent Pool in Romania: Why Global Companies Hire Developers Here

The Real Cost of Software Outsourcing: Why Romania Offers the Best ROI