- Industry insights

- People in tech

- Product development

- Tech trends at BEECODED

- 23 Jul 2025

How Finance Teams Save $100K Annually Through Smart Automation

In today’s article, we’re sharing a real success story.

Table of contents

Contributors

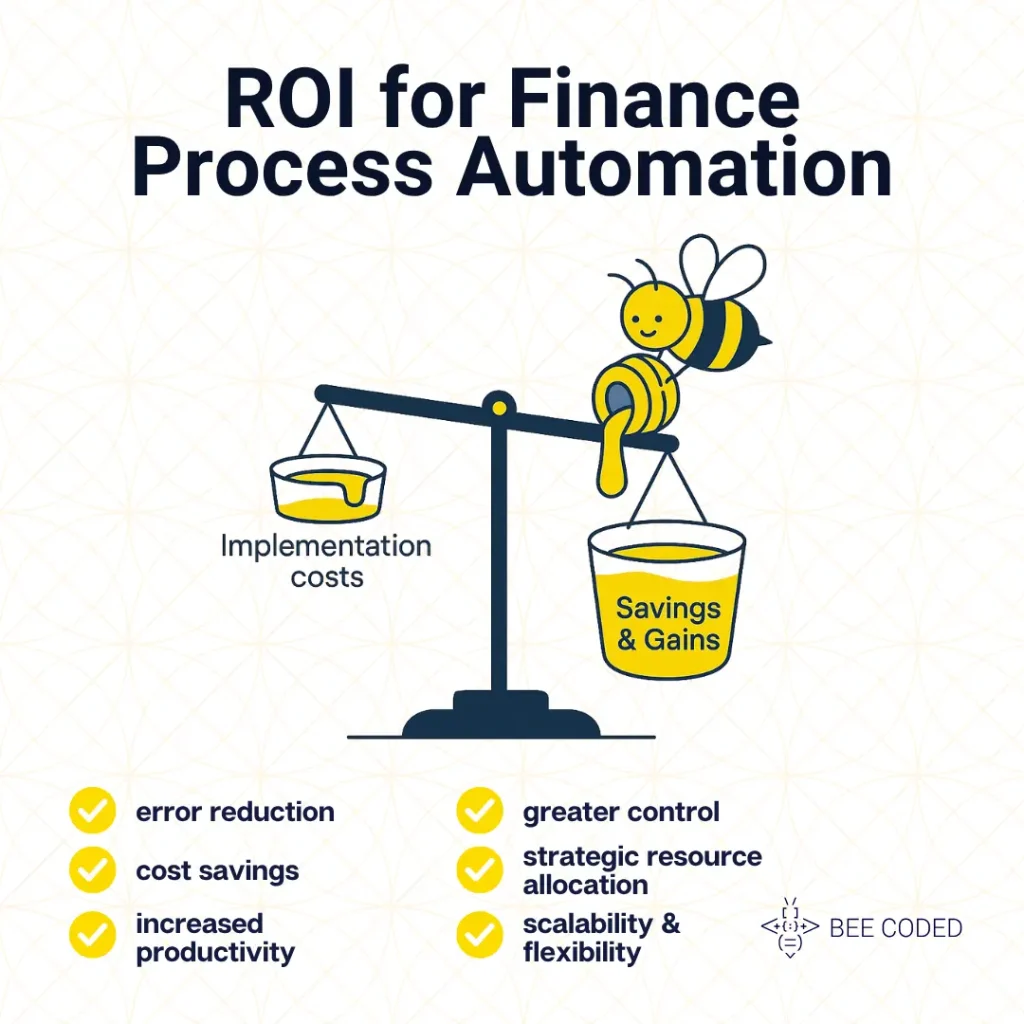

We get it—the first thing that naturally comes to mind when you hear about finance automation isn’t “How much can we gain?” but rather “How much will it cost us?”. And that’s perfectly fair—every investment comes with a careful ROI calculation.

But what if, this time, we flipped the perspective just a bit?

Let’s ask ourselves something else: How much could we actually save through finance automation?

In today’s article, we’re sharing a real success story—one that resulted in cost savings of $100,000 annually for a client of ours. And all of the automation process was delivered in just 3 weeks.

It may be that your company’s big turning point could also happen in just three weeks. Read on to find out how.

The Growing Pain of Manual Finance Processes

Let’s start with an uncomfortable truth: manual data handling is the number one killer of finance team productivity.

Manual invoice processing, reconciling bank statements line by line, putting together endless Excel reports—these tasks mean hours wasted, costly errors and sometimes even missed opportunities.

Data ends up scattered in multiple locations, hard to access and your entire process often depends on one key person. If they’re out sick or on vacation, the whole flow stops. This increases your risk of delays or late fees.

In the long run, the real cost of “doing things manually” becomes harder and harder to justify, especially when there are efficient alternatives.

How Finance Automation Works

So, what does finance automation actually mean? In essence, it’s about eliminating repetitive, time-consuming tasks and replacing them with automated workflows that run smoothly with minimal human intervention. By adopting automated financial processes, your team gains:

- Centralized, instant access to financial data

- More accurate, faster financial reports

- Complete visibility of your cash flow

- Time freed up for high-level analysis and strategic decisions

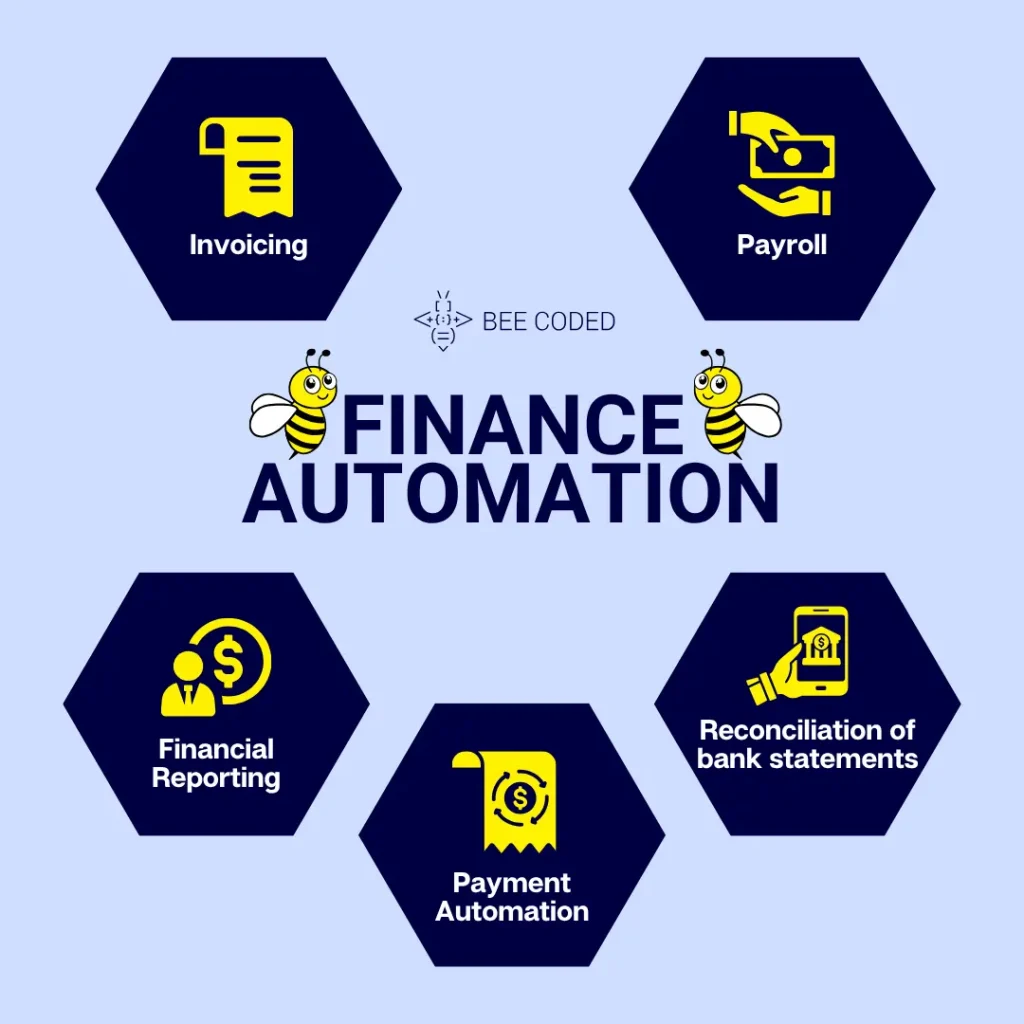

Examples of Finance Automation

Here are just a few practical examples of how automation can transform your finance operations:

- Invoicing: sending and processing invoices automatically, with no forgotten or duplicate bills.

- Payroll: making recurring payments accurate, timely and fully compliant, without month-end stress.

- Financial reporting: automatically collecting, aggregating and presenting data in clear reports, on time.

- Payment automation: eliminating human errors and late payments with fast, secure processing.

- Reconciliation of bank statements: no more manual matching, spreadsheets or confusion—the system does it for you.

Finance Automation Benefits

When it comes to benefits, the numbers speak for themselves:

- 90% reduction in reporting errors thanks to automated workflows

- 30-40% faster task completion by optimizing financial processes (source: philliphughes.co.uk)

On top of that, the finance automation ROI is easy to see when you look at the real benefits companies get:

- Cost savings: fewer billable hours, less wasted resources, lower overhead.

- Increased productivity: your teams focus on strategic work, not repetitive tasks.

- Greater control: full transparency over processes and data, anytime.

- Strategic resource allocation: time and budgets are spent where they add the most value.

- Scalability & flexibility: automated systems can grow and adapt as your business expands.

- Risk mitigation & compliance: automated systems can be programmed to comply with the latest regulations and standards.

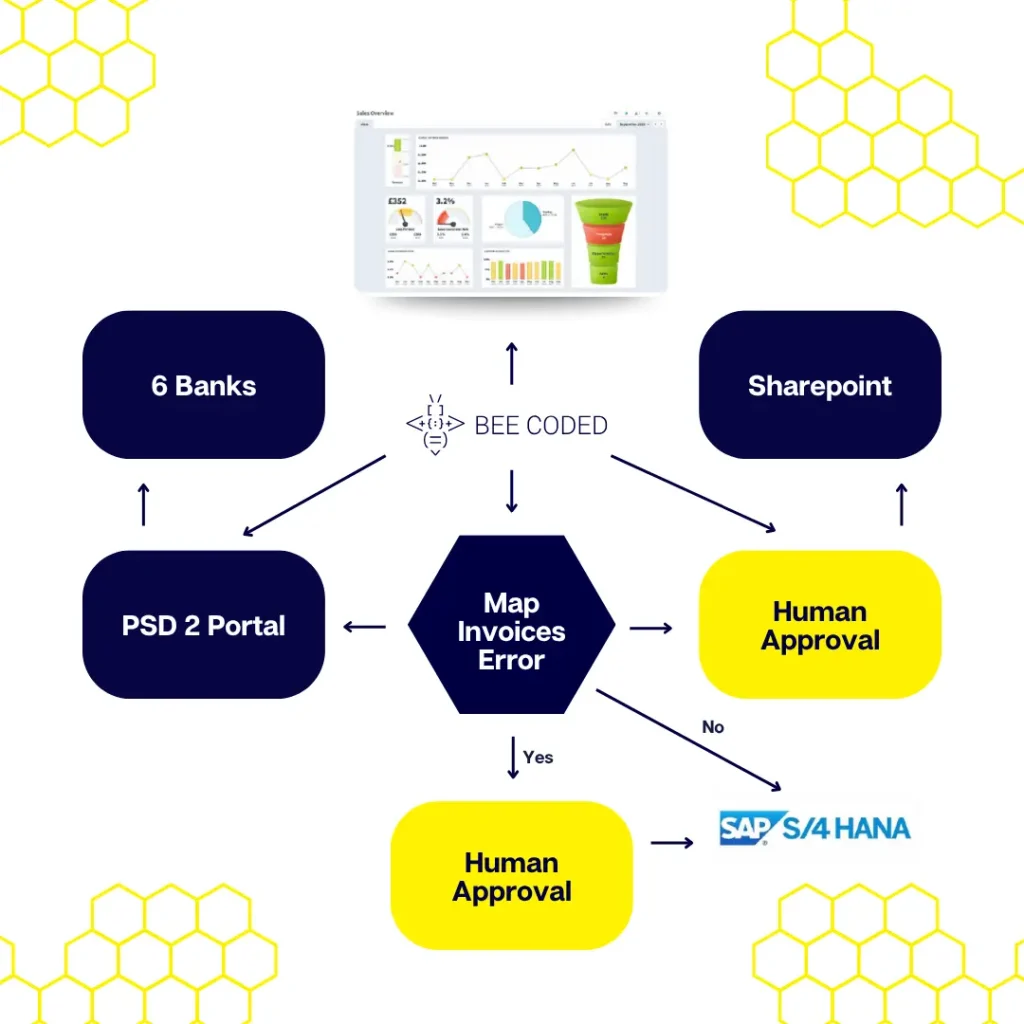

Real Story: Saving $100K Annually Through Smart Finance Automation

Now, let’s look at a real example.

The challenge: One of our BEE CODED team clients was struggling with an error-prone manual process for reconciling bank statements across six different banks.

The solution: We implemented a strategic finance automation platform that connected directly to all six banks and handled reconciliation automatically.

The results:

– $100,000 annual savings in staff and infrastructure costs

– Outdated legacy systems eliminated

– Delivery time: 3 weeks

Why does automated reconciliation work?

- Connecting directly to banks – No more manual downloads or formatting

- Matching transactions in real time – Instantly flags discrepancies

- Learning from patterns – Improves accuracy with every reconciliation

How can you achieve the same savings?

It all starts with one simple question: Which repetitive tasks are draining your finance team’s time and energy?

We automate those tasks that hold your team back. With our customized, user-friendly solutions, you’ll:

- Reduce your team’s manual workflows

- Connect all your business tools seamlessly

- Automatically gain clear business insights from your data

- Cut down operational costs and boost efficiency.

In Summary

Finance automation is freeing up your teams from repetitive work, enabling professional growth and helping you make faster, smarter decisions.

If you want to discover how finance automation could transform your team’s day-to-day work and bottom line, reach out to us today.

Want to automate other areas too? Check out our articles on HR Workflow Automation and ERP Workflow Automation to unlock even more time savings across your business!

How Supply Chain Automation Can Save You Hundreds of Labour-Days and Maximize ROI

HR Workflow Automation: Cut Onboarding Time by 60% While Ensuring Compliance

How to Reduce Financial Close Time by 3 Days with ERP Workflow Automation